How to Get SR-22 Non-Owner Insurance Coverage?Īccess Auto Insurance is authorized to provide Arizona and Indiana drivers with SR-22 and Non-owner SR-22 coverage. You are not covered, but you are protected from getting a ticket or license suspension you would receive if you were driving without this insurance coverage. ( Read more about liability coverage here) This is the state minimum coverage and only covers other individuals and their vehicles.

This would cover bodily injury liability and property damage liability. Non-owner SR22 includes basic liability insurance, but does not include collision coverage. Access Auto Insurance specializes in filing a Non-Owners SR-22 fast and affordably. If you get a ticket which requires you to purchase an SR-22 policy, but do not, your license may be suspended or additional fines may incur. If you are driving a friend’s car, or any car that isn’t your own, and that car is uninsured, the driver will be held responsible for driving without insurance. This is a requirement after license suspension in many states, including Arizona and Indiana.

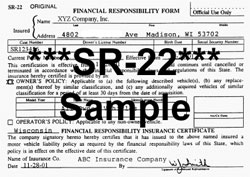

The policy is protection for the policy holder, not a specific vehicle. If you do not own a car, you will still need to purchase this form, although it will then be a non-owner SR22 form, also referred to as an operator or named-operator policy. To reinstate your driver’s license, after it has been suspended, you may be required to purchase an SR-22 ( Read more about an SR-22 here). What is Non-Owner SR22 Auto Insurance? Is it different between states, such Arizona and Indiana?

0 kommentar(er)

0 kommentar(er)